-

what does 3rd world debt mean

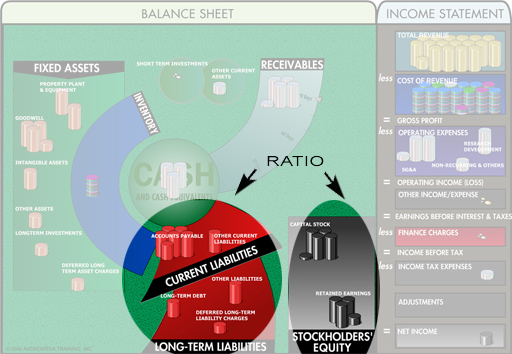

Debt-to-Equity Ratio Definition, Example & Formula | InvestingAnswers

Using the debt-to-equity formula and the information above, we can calculate that Company XYZ's debt-to-equity ratio is: $15000000/ $10000000 = 1.5 times, .

http://www.investinganswers.com/financial-dictionary/ratio-analysis/debt-equity-ratio-358

-

what does mortgage pre approval mean

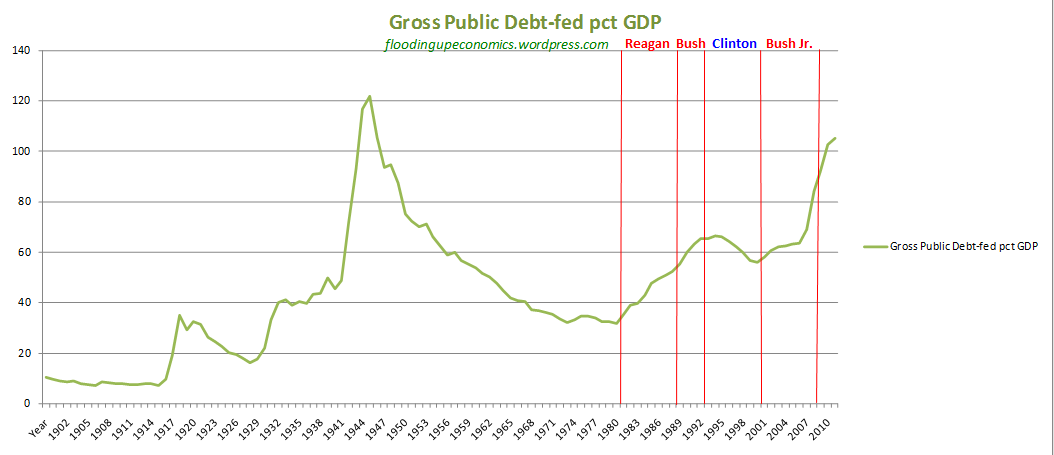

Debt-to-GDP ratio - Wikipedia, the free encyclopedia

Governments aim for low debt-to-GDP ratios and can stand up to the risks . advocate using it as the key measure of a credit bubble (both its level and its change .

http://en.wikipedia.org/wiki/Debt-to-GDP_ratio

-

acv home insurance

Auditing debt/ratio and debt/equity ratio - AllExperts.com

Oct 5, 2000 . You can use the above to measure whether a firm is risky or not. Normally an acceptable Debt Equity Ratio is a maximum of 2 : 1.

http://en.allexperts.com/q/Auditing-1810/debt-ratio-debt-equity.htm

-

what do when credit card closed

A Low Debt To Equity Ratio

How a low debt to equity ratio can lead to stellar stock market investment returns. . to effectively measure a company's debt load using the debt-to-equity ratio.

http://www.your-roth-ira.com/low-debt-to-equity-ratio.html

-

bankruptcy undue hardship student loan tennessee

Debt Management Ratios

Debt Management Ratios attempt to measure the firm's use of Financial . Debt is called Financial Leverage because the use of debt can improve returns to .

http://www.zenwealth.com/BusinessFinanceOnline/RA/DebtManagementRatios.html

-

what do mortgage lenders look at

Debt sustainability: how to assess whether a country is insolvent

Such gaps do not provide a direct measure of which stock of debt (divided by an appropriate scale variable) is sustainable. But if the initial debt ratio is too high, .

http://people.stern.nyu.edu/nroubini/papers/debtsustainability.pdf

-

why use mortgage broker

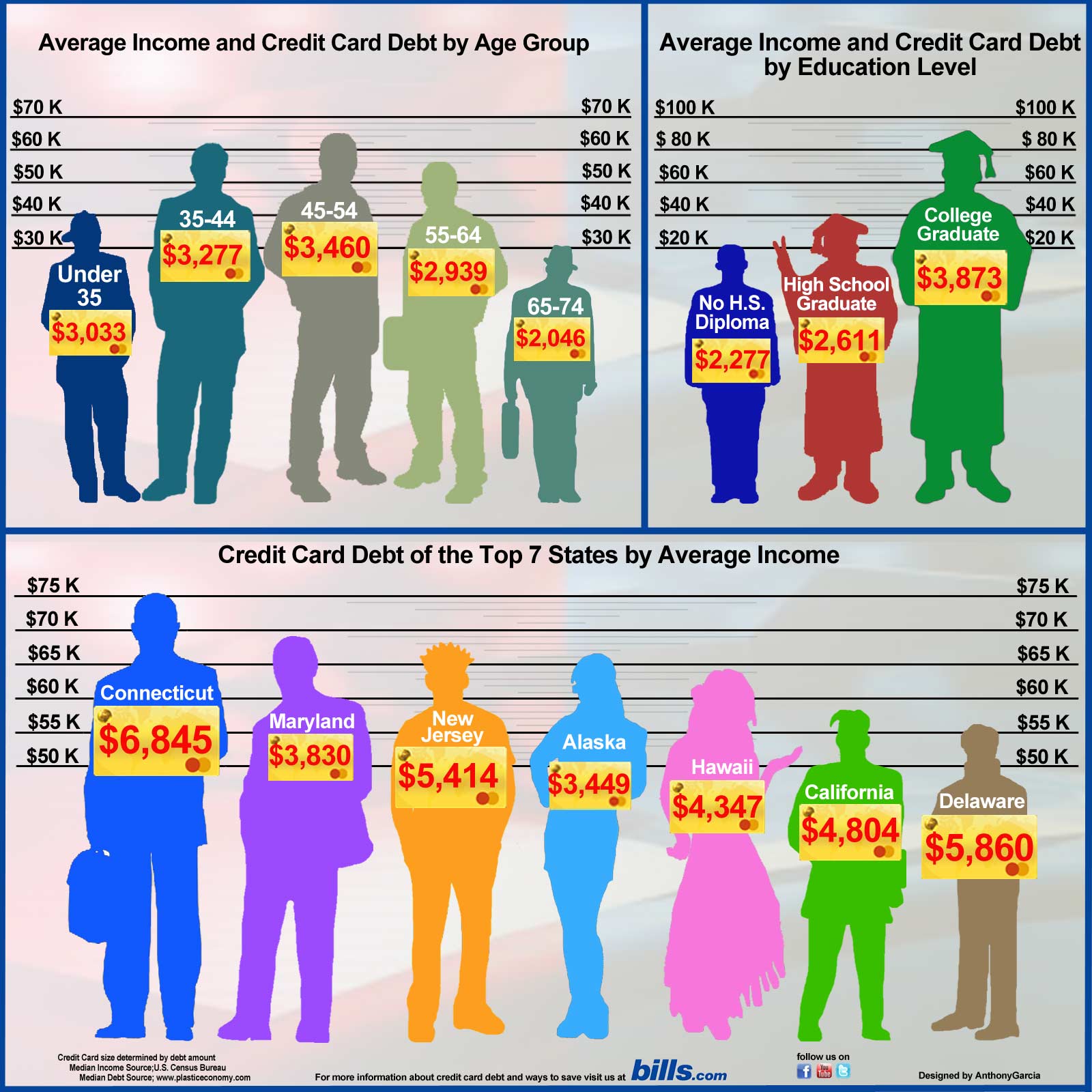

DTI: Debt-to-Income Ratio Definition and Data

Mar 21, 2012 . Don't borrow more than you can comfortable repay. . To calculate your debt-to- income ratio, take your monthly debt payments (for you house, .

http://www.bills.com/debt-to-income-article/

-

what does home insurance not cover

Debt/Equity Ratio: Definition from Answers.com

Measure used in the analysis of financial statements to show the amount of . Also known as the Personal Debt/Equity Ratio, this ratio can be applied to .

http://www.answers.com/topic/debt-equity-ratio

-

bankruptcy info debt articles

Debt to Equity Ratio

Definition: The Debt to Equity Ratio measures how much money a company should safely be able to borrow over long periods of time. It does this by comparing .

http://beginnersinvest.about.com/cs/financialratio/g/debttoequity.htm

-

mortgage georgia direct lender

Debt/equity ratio - Financial Dictionary - The Free Dictionary

Debt/Equity Ratio. What Does Debt/Equity Ratio Mean? A measure of a company's financial leverage calculated by dividing its total liabilities by its stockholders' .

http://financial-dictionary.thefreedictionary.com/debt%2Fequity+ratio

-

what does mortgage maturity mean

Debt/Capital Ratio - QFINANCE

The debt/capital ratio is also a measure of a company's borrowing capacity, . it can be misleading to assume that the lowest ratio is automatically the best ratio.

http://www.qfinance.com/balance-sheets-calculations/debt-capital-ratio

-

quotes mortgage rates ny

Financial Ratios

This ratio measures the ability of general management to utilize the total assets of . How much debt can a company take on before the benefits of growth are .

http://mercury.webster.edu/westedou/financial_ratios.htm

-

christian counseling debt program

How Do I Calculate My Debt-to-Income Ratio?

Lenders look at your debt-to-income ratio when they consider whether you are creditworthy. Here's how you can calculate your own debt-to-income ratio.

http://www.mindyourfinances.com/credit-debt/credit-basics/081104-7

-

what do junk debt buyers get

How to Calculate Your Debt-To-Income Ratio | InCharge Debt ...

One of the easiest ways to get a picture of your current financial standing is to calculate your debt-to-income ratio. Monitoring your debt-to-income ratio can help .

http://www.incharge.org/money-101/debt-relief/how-to-calculate-your-debt-to-income-ratio

-

what do i need car loan

Becoming Debt Free » Blog Archive » What Does Your Debt Ratio ...

This individual's debt ratio can be determined by adding the monthly payment amounts . Your debt ratio is an important measure regardless of your income.

http://www.debtopedia.com/debtfree/credit-reports/what-does-your-debt-ratio-mean.php

-

what does home improvement means

Financial Strength Ratios for Investment Analysis - For Dummies

Too much long-term debt costs money, increases risk, and can place restrictions on management in . Use the cash flow to earnings ratio as a base measure: .

http://www.dummies.com/how-to/content/financial-strength-ratios-for-investment-analysis.html

-

unsecured credit card application no fees

Analyzing Financial Statements, Part 2 of 2 :: HVACR Business

Do not include any receivables or payables from employees, officers, friends, relatives, . The debt-to-equity ratio measures the capitalization of the company.

http://www.hvacrbusiness.com/issue/article/407/analyzing_financial_statements_part_2_of_2.aspx

-

what do health insurance do

Interactive Elements: What Does it Take to Qualify for a Mortgage?

You do not need to include information about alimony, child support, disability . To calculate your front debt-to-income ratio, enter what you pay for your housing .

http://www.marianydesigns.com/qualifying-for-mortgage.html

-

list all countries debt

Net Debt Definition | Investopedia

And, finally, how does it compare to the debt levels of competing companies? . These five performance ratios will help you measure how good your money .

http://www.investopedia.com/terms/n/netdebt.asp

-

what does a debt help do

Debt to Income Ratio | The Truth About Mortgage.com

A definition of the debt to income ratio, also known as the DTI ratio. . What Mortgage Rate Can I Get With My Credit Score? Why Are Mortgage . It also allows the bank or lender to gain a true measure of a borrower's ability to handle debt.

http://www.thetruthaboutmortgage.com/dti-debt-to-income-ratio/